S1E3: Trump's Bank War: Why his Tariffs Create a Historic Dilemma for the FED

Echoes of Jackson, FDR, Truman and Nixon Explain Current Objectives

While historical events rarely repeat themselves, a closer examination reveals very often that they in fact do rhyme. It appears fair to characterize Trump as an ego-driven individual, his constant comparison to the greatest American Presidents, can be interpreted as an indicator that leaving a legacy is his primary concern. In his second term his appetite for risk seems to be higher than ever. Based on that I have illustrated the historical parallels to the two high tariffs phases in US history, identified contradictions within the Trump administration's approach, and laid out an interpretation of the actual underlying objectives of his Liberation Day Speech.

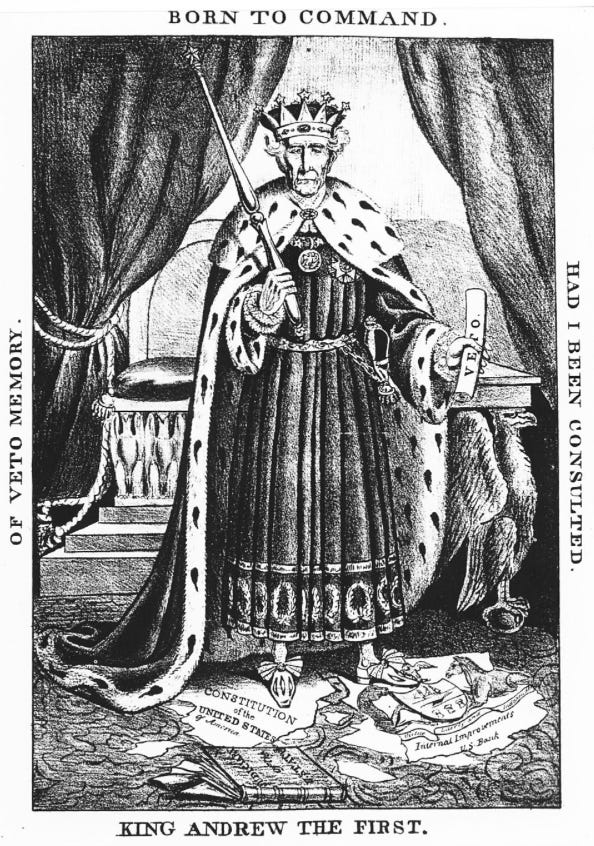

Chapter 1: Jackson's Bank War and the Seeds of Civil War Division

I am one of those who do not believe that a national debt is a national blessing, but rather a curse to a republic; inasmuch as it is calculated to raise around the administration a moneyed aristocracy dangerous to the liberties of the country.

- Andrew Jackson

On January 8, 1835, Washington's political leadership celebrated Andrew Jackson's elimination of the national debt, a feat announced by a senator with: Gentlemen...the national debt...is PAID. It was the first time a debt-free status was archived in US history. It lasted merely one year. The subsequent economic collapse, culminating in the 1837 depression, which cultivated the American divide leading to the Civil War.

Prior to his presidency, Jackson engaged in land speculation in Tennessee. A personal experience involving a failed land transaction which resulted in substantial personal debt and worthless paper notes, instilling in him a strong aversion to the debt-based banking system. Consequently, during his presidential campaign, Jackson targeted banks and the national debt as primary adversaries, labeling the latter as a national curse, a sentiment that garnered significant public support during his campaign.

Following his 1828 election, he signed a bill into law that significantly increased tariffs, reaching as high as 50%. Similar to arguments currently used by Trump, the rationale was that this protectionist measure would stimulate domestic job growth and simultaneously reduce the national debt. However, this policy led to a substantial contraction in international commerce, with both imports and US exports experiencing notable declines of 50% and 20%, respectively.

To still deliver on his set goal of debt elimination, Jackson pursued a policy of aggressively curtailing federal spending, vetoing infrastructure projects, and implementing the Trail of Tears – a brutal forced displacement and dispossession of Native American tribes that resulted in numerous deaths. The subsequent sale of vast tracts of these newly acquired lands to private speculators provided a significant portion of the funds needed to reach his financial objective.

He crushed opposition to his radical policies that were perceived by many as executive overreach. When the Supreme Court declared in a landmark decision that the state of Georgia did not have the authority to regulate the Cherokee Nation’s territory, Jackson, who was known for his strong belief in states’ rights and his disdain for Native American tribes, disregarded the Court’s decision and famously stated:

The Supreme Court has made its decision, now let them enforce it.

His sweeping financial policies exacerbated existing regional tensions within the United States. The industrialized Northern states generally perceived his trade policies as beneficial, while the agrarian Southern states, reliant on international markets, experienced significant economic hardship. When his Vice President John Calhoun sided with Southern States, specifically South Carolina, which argued that the states had the right to nullify the federal trade tariffs, he purportedly said:

John Calhoun, if you secede from my nation I will secede your head from the rest of your body.

By many historians Jackson’s presidency is considered to have set the stage for the Civil War that followed two and a half decades later. Especially because he understood to use the anger, fear and the divide his policies caused to his advantage: Jackson ran in the 1832 presidential race on a platform representing the planters, the farmers, the mechanic and the laborer against the monied interest. He argued that those hit the hardest by his policies were actually victims of the unconstitutional public–private organization of the Second Bank of the United State (BUS) which would violate state sovereignty and was called by him repeatedly a Hydra of Corruption. After assuming office, he promptly initiated the removal of federal deposits from the BUS, redistributing these funds to various state banks. Those banks were chosen by Jackson and run by loyal political allies which were part of his Jacksonian Democracy Movement. One might say he raised around his administration a moneyed aristocracy - exactly what he blamed his opposition to do in the opening quote of this essay. BUS’ president Nicholas Biddle retaliated to that by imposing tight money policies by calling back loans and restricting the issue of new ones. While Jackson’s actions were widely perceived as another abuse of executive power, he successfully managed to blamed Biddle’s repercussions for the economic downswing and pressured the BUS to reverse their tight monetary policies which ultimately resulted in Jackson decisively winning the Bank War.

There are notable perceived similarities between Jackson’s actions against the Central Bank and Trump’s approach: Even though almost 200 years apart, the arguments to impose tariffs, that are essentially a tax on his own constituency, are almost identical creating the same dilemma for the Central Bank: To fight inflation, a tight monetary policy such as increasing interest rates and generally making it harder to obtain credit would be needed, on the other hand low rates and uncomplicated access to credit is what is needed to grow and establish domestic industries, lessening the hardship for US citizens. The argument down the line feels predictable: Monetary policy for China or American workers?

Jackson caused and then used to not only force the Central Bank’s hand, but essentially abolish and replace it by a system where figures loyal to him were allowed to establish charter banks that issued their own currencies. I have described the infiltration of leading figures of the neoractionary movement, such as Thiel or Musk, that founded what became PayPal with the vision to substitute the US dollar, or Armstrong’s Coinbase as well as it’s former CTO Srinivasan who publicly advocate for the end of the dollar as world reserve currency as well as call to audit and End the FED in my essays S1E1 as well as S1E2, which focuses specifically on the sale of federal land to private tech elites to establish Chapter Cities with the goal to merge them into an UN recognized nation.

Jackson’s state banks, which he called Pet Banks, operated under looser lending procedures than the national bank, using the federal deposits handed to them as basis to print large amounts of money to grant risky loans, fueling investments in land and all kind of other asset classes. The resulting inflation and unsustainable lending practices led to a surge in speculation, which was followed by a sharp contraction in the economy and the Panic of 1837. Many state banks, unable to meet the demands of depositors and creditors, closed their doors, triggering a period of economic instability that fueled the divide within the US that led to the Civil War. The financial and economic instability lasted until the Federal Reserve System was created in 1913. While this era fostered significant hardship for millions, it enabled the rise of powerful monopolists like Vanderbilt, Morgan, Rockefeller or Carnegie. Circumstances that Thiel describes in his book Zero to One as desirable.

Chapter 2: Federal Reserve Act, Great Depression and the Post-War Era

Our great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the Nation, therefore, and all our activities are in the hands of a few men […] We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world — no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of small groups of dominant men.

- Woodrow Wilson

The tension between private and public interests in shaping monetary policy is a debate with a long and rich history, likely as old as the concept of money itself. This fundamental question of influence has persisted for centuries. Wilson’s above quote from his 1913 book The New Freedom, is no exception. So Trump can arguably understand himself in respectable society when he stated in November 2024:

I feel the president should have at least a say in there. I feel that strongly. I made a lot of money. I was very successful. And I think I have a better instinct than, in many cases, people that would be on the Federal Reserve — or the chairman. [adding about Powell] He’s tending to be a little bit late on things. He gets a little bit too early and a little bit too late. I believe it’s really a gut feeling.

Wilson assumed office following a period of frequent bank runs that persisted since the end of the Civil War, he managed to balance the competing interests by capitalizing on the widespread consensus that reform was necessary. On December 23rd of the same year, he signed the Federal Reserve Act into law, establishing the 3rd US Central Bank.

The balance he was able to justify limited private influence initially significantly, which inadvertently contributed to monetary policy becoming a tool for short-term electoral gains. The post-World War I economic landscape saw American business’ boom, fueled in part by the exclusion of Germany and other in the war involved nations from the US market – a situation American business sought to maintain. Rising American wages also generated fears among businessmen that lower European labor costs would lead to undercutting. Consequently, figures like Joseph Fordney advocated for tariffs as a means to safeguard American jobs. This America First sentiment, advocating self-sufficiency and isolationism from the old world with a focus solely on North America, permeated the US and ultimately contributed to the economic collapse of the Great Depression in 1929.

By 1933, the crisis had brought the US economy to its knees, with a staggering 25% unemployment rate, a 90% decline of the Dow Jones, and the failure of 35% of the nation's banks. Facing an inability to meet its debt obligations – which has officially never happened in US history - with the exception of the four times it actually has – the Roosevelt administration took decisive action. FDR - the only US President who served more than two terms - issued an executive order changing the official gold exchange rate from $20.675 to $35.00 per ounce, prohibited private ownership of gold, and effectively ended the redemption of deposited gold for currency. This effectively devalued the US dollar and the government's outstanding debt by approximately 40%.

Amendments to the Federal Reserve Act in 1935, which excluded the Treasury Secretary and the Comptroller of the Currency from the Board, were a reaction to the obvious influence the FED’s structure had on the creation of the Great Depression. While the direct control of the had lessened, Congress and the executive branch maintained significant influence over the Federal Reserve through now more indirect channels. The economic hardships of the interwar period fueled a rise in international tensions, as nationalist movements gained prominence and became the dominant global ideology. How the arguments of the neoreactionary movement resemble those of the reactionaries of the 1920s and 1930s, I have outlined in S1E1. The parallels to the America First sentiment are probably obvious.

During World War 2 the FED committed itself to maintaining an interest rate of ⅜ percent on Treasury Bills to finance the American war effort. After hostilities ended, the Treasury Department was committed to keep the interest rates low, while inflation increased in the post-war years tensions between the executive branch and the monetary experts at the FED escalated. As consequence the Truman administration singed the Treasury-Federal Reserve Accord in 1951 into law which again marked a significant step towards greater FED autonomy and private influence over the monetary policy. Only months later a public altercation between Truman and FED chairman McCabe regarding interest rates at the wake of the Korean War ironically ended with the following announcement by the President:

McCabe was informed that his services were no longer satisfactory, and he quit.

The Bretton Woods Agreement of July 1944 had turned the US dollar into the world reserve currency. This agreement, negotiated by delegates from 44 Allied nations at the United Nations Monetary and Financial Conference in Bretton Woods, New Hampshire, established a new international monetary system in the aftermath of World War II. The core of the system was a regime of fixed exchange rates. Each member country pledged to maintain the value of its currency within a narrow margin (initially 1%) of a declared parity, which was pegged to the US dollar. The dollar on the other hand was based on the Gold Standard meaning that gold could be converted at a fixed rate of $35 per ounce.

The United States, possessing the only major economy largely unscathed by World War II, presented a simple proposition to the devastated nations of Europe and Asia: Abolishment of imperial ambitions to establishment peaceful intra-regional trade frameworks in exchange for access to the expansive US market and credit system, while the US Navy's dominance in the Atlantic and Pacific would guarantee safe trade routes globally. Given the historical context of disrupted commerce due to centuries of piracy and imperial rivalry, this offer presented was almost too good to be true.

The Bretton-Woods era concluded in 1971 with the Nixon Shock, an event triggered, in part, by the growing sentiment among European allies that the Bretton Woods structure no longer represented a fair global economic order. Germany was among the first to decouple its currency from the US dollar, sensing that the US was about to default on their Gold Standard promise once again, setting off a chain reaction. The Nixon administration responded with a series of economic measures, most notably the suspension of the dollar's convertibility to gold, effectively transforming the US dollar into a fiat currency – one whose value is not based on any intrinsic commodity.

Those events were another famous test of the FED’s independence: President Richard Nixon, pressured then-FED Chairman Arthur Burns to ease up on monetary policy to boost the economy ahead of the 1972 election. On the infamous Nixon tapes that later forced him to resign he stated:

I respect his independence. However, I hope that, independently, he will conclude that my views are the ones that should be followed.

An Fortune article concludes:

In part because of Nixon’s pressure, inflation skyrocketed during the 1970’s while economic growth slowed to create stagflation that lasted well after Nixon resigned in 1974. The oil shock in 1973 also sent gas prices soaring and stoked more inflation. These economic headwinds were only halted by the drastic interest rate hikes of Burns’ successor Paul Volcker.

Essentially Nixon’s policies handed the US a truly unlimited credit card though. The American economist Barry Eichengreen concluded:

It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one.

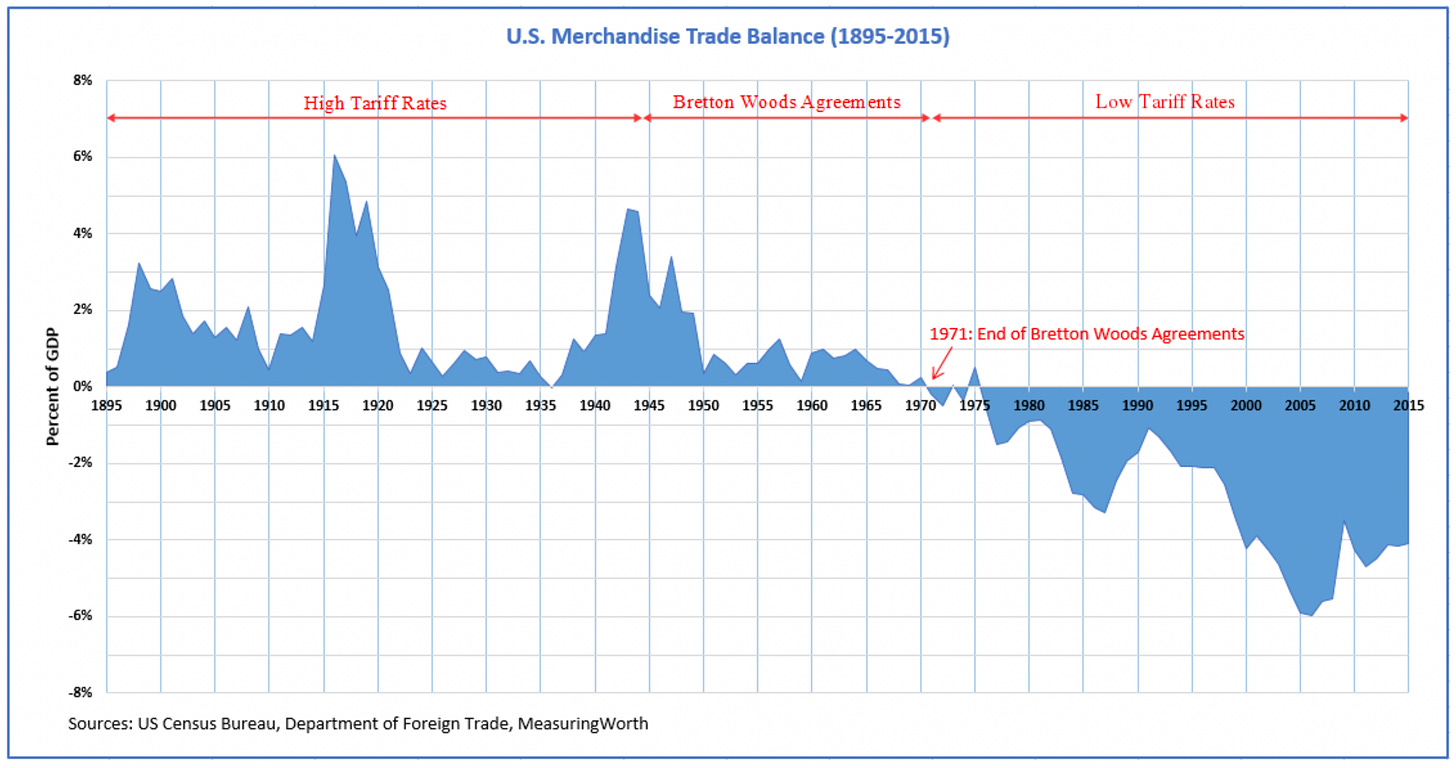

The following chart shows what he meant:

The U.S. transitioned from a net importing country into one with unlimited global purchasing power, with a fiat US dollar underpinned by the nation's significant economic and military strength, which discouraged challenges to its value.

The Nixon shock enabled the ultimate rise of the US Empire establishing itself as the successor of its British predecessor, which used to amass extensive deficit and debt trading with its colonies over centuries itself. I guess it is fair to say that not even Trump would be bold enough to argue that it was the colonies that ripped the Brits off, yet that is his stance on the US trade deficit today;

Chapter 3: The Challenge of De-dollarization and Shaping the Next American Century

Trump's recurring assertion that countries with a trade surplus with the US are ripping us off is inaccurate on multiple fronts as Noah Smith argues in this latest Substack correctly:

Trump's advisors apparently focused on the GDP equation and observed that imports are subtracted. However, they seemingly failed to grasp that this subtraction is an accounting mechanism to offset the fact that the value of imports is already included within the consumption and investment figures. Consequently, imports do not inherently reduce GDP.

The assumption that eliminating imports will automatically lead to a one-to-one increase in domestic production – the idea that stopping the import of a drill from Europe, for example, will simply result in an American company making one more drill – is a significant oversimplification of economic reality.

In fact, those two inaccuracies actually even mutually reinforce each other. It is in general a weird way to argue: If you go to Walmart and pay with your credit card, does that mean that Walmart is ripping you off? No. Does paying with your credit card make you poorer though? Also no - you have indeed less money, you have simply exchanged it for stuff though. And if you are the leading empire of your time possessing the global reserve currency grants to the luxury that you can simply print more money when you run out of it.

Trump has incredibly capable advisors, including Thiel and Musk, in his administration, which not only understand the economic implications of tariffs, but are more than just qualified to play 3D Chess. So the question is, what strategic objectives motivates them?

To me their timing is driven by three major factors:

Foreseeable population collapse in Europe and developed Asia

People aged 25-40 are the biggest consumers in the developed world. Germany is 45 on average, Italy 47, Japan 50, while the US is 39. The economic rationale for maintaining a costly global (military) infrastructure primarily to secure trade is increasingly being questioned, particularly given the enhanced economic opportunities within North America compared to a century ago.

De-dollarization

The global order is transitioning towards a multipolar structure, leading to a discernible and accelerating decline in the US' capacity to unilaterally enforce dollar-denominated trade. This trend is evidenced across various sectors, including energy transactions, the emergence of alternative payment systems, and the diversification of currency reserves in emerging markets. Even JP Morgan began to argue like that recently.

Refinancing

Due to the $9.2 trillion debt refinancing requirement in 2025, a strategy of creating economic uncertainty might push investors out of equities and into the relative safety of bonds. This increased demand for bonds could lower interest rates, with a 0.5% decrease potentially saving the government approximately $500 billion in interest over a 10 year period.

The theory that Trump instigated a trade war to lower future debt costs has been floated around for a while. Yet, using this as stand-alone explanation is unconvincing to me. The trade-off of causing trillions in immediate market losses for the possibility of saving billions over years appears to be an extremely unfavorable proposition.

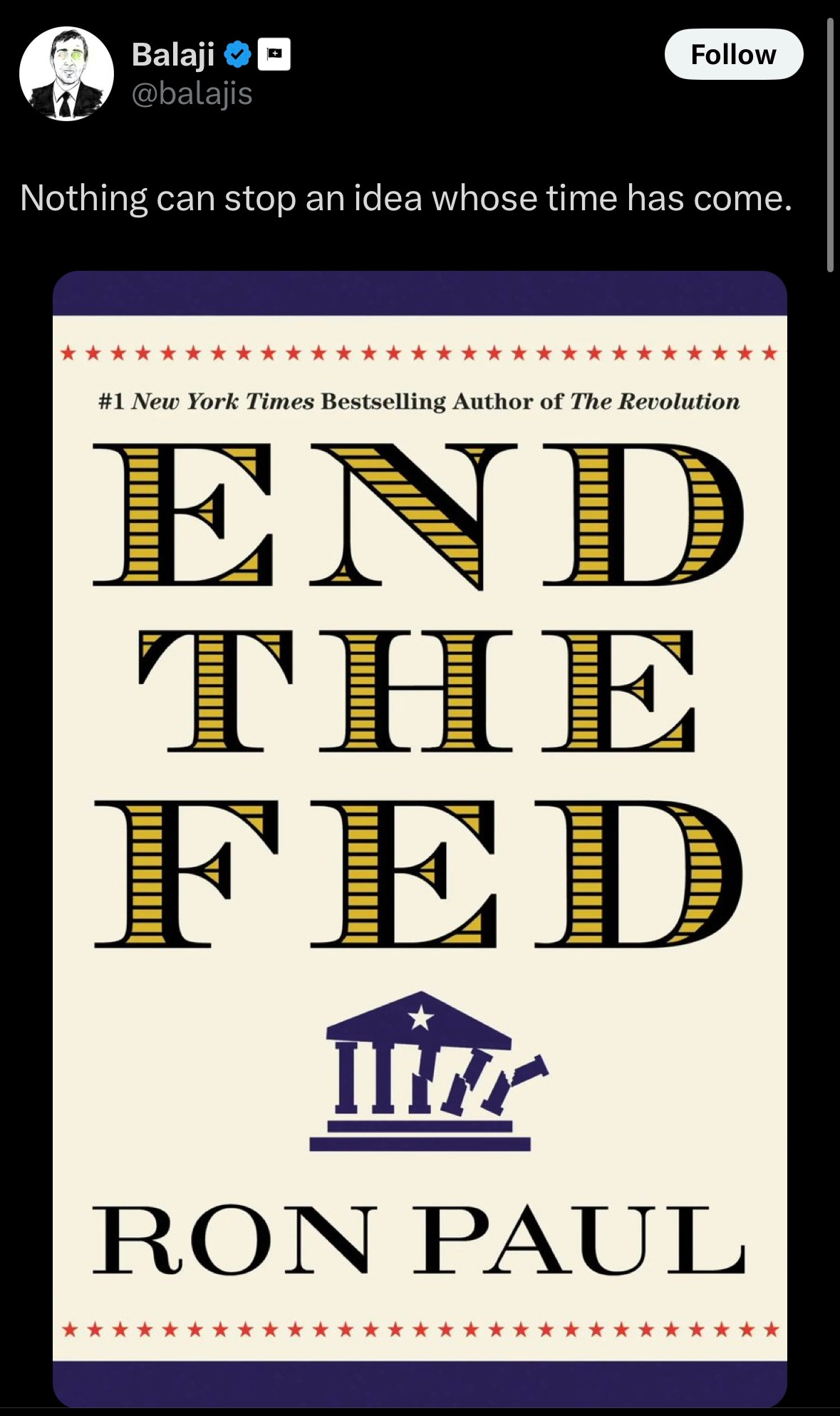

A more plausible scenario, in my view, involves an orchestrated attack on the Federal Reserve as part of a plan to reshape the US. Several advisors and advocates associated with the neoreactionary movement, including Srinivasan and Musk, whose involvement in the Chapter City legislation I detailed in S1E2, have been advocating for the dismantling of the Federal Reserve in recent months. The following Tweet is just one of several examples of what appears to be a purposefully orchestrated debate:

Musk e.g. also retweeted a post targeting the FED stating The FED is insanely overstaffed or commenting on a post suggesting that Ron Paul should be used to audit the FED as Great idea.

Trump tariffs effectively place the Federal Reserve in a position analogous to that faced by Jackson nearly two centuries ago. The Federal Reserve's response to inflation – tightening monetary policy – would, paradoxically, benefit China, Europe, and other trade partners targeted by the tariffs, while simultaneously exacerbating the economic challenges faced by US farmers, small businesses, and other domestic sectors. Trump can easily turn the public debate into one that is basically boiled down to Is the FED pro Americans or pro China? Directing the fear and anger of his constituency towards the FED creating the grounds to increase the influence of the executive branch onto the FED to a pre-WW2 level putting him in a position to devalue the dollar comparable to FDR in 1933, which would solve the foreign debt problem, while it creates room for new, asset-backed cryptocurrencies to be used as legal tender, while the USD is inflated out of relevance.

Historically potential shifts in the global order, as we are currently seeing them play out, bear a great risk of internal or external conflict. In his announcement abolishing the Gold Standard, Nixon repeatedly emphasized that another war was not a viable option, stating, for example:

Prosperity without war requires action on three fronts: We must create more and better jobs; we must stop the rise in the cost of living; we must protect the dollar from the attacks of international money speculators. We are going to take that action – not timidly, not half-heartedly, and not in piecemeal fashion. We are going to move forward to the new prosperity without war as befits a great people – all together, and along a broad front.

He said that understanding the historical precedence over the past five centuries wherein a declining dominant power more often than not engaged in war with a rising power. (12 out of 16 times) If the collapse of a reserve currency, which has always been coupled with significant wealth disparities within that nation holding it, meant historically a significant risk for internal conflict or even civil war. Elon Musk has described the latter at least 8 times over the last 12 months as inevitable - debating events in the US and Europe.

I do not believe that anybody wants to see an armed conflict unleashed. But as Thomas Schelling said in Arms and Influence:

The purely ‘military’ or undiplomatic’ recourse to forcible action is concerned with enemy strength, not enemy interests; the coercive use of the power to hurt, though, is the very exploitation of enemy wants and fears.

Use of force is a bargaining chip in diplomacy, as such we see the biggest US military buildup in over a decade happening in the Middle East right now, while Israeli sources share intel that claims Iran would have nuclear capabilities within three weeks, which was followed with a clear war threat by Trump last week:

If they don't make a deal, there will be bombing. It will be bombing the likes of which they have never seen before.

Similar to the approach Truman took towards the Federal Reserve during the buildup to the Korean War, Trump's current troop movements and rhetoric regarding Iran, and the broader global implications, create a scenario where the Federal Reserve's actions are potentially additionally constrained. The threat of conflict in the Middle East, even if not realized, carries the risk of significant oil price volatility, which would disproportionately harm the EU, China, and other trading partners with whom the US seeks trade agreements. All this is especially made possible by the recently archived energy independency of the US.

While Jackson’s policies and the Civil War had horrible consequences for the majority of American’s, they were the basis of the Gilded Age and the creation of the most powerful monopolist in American history.

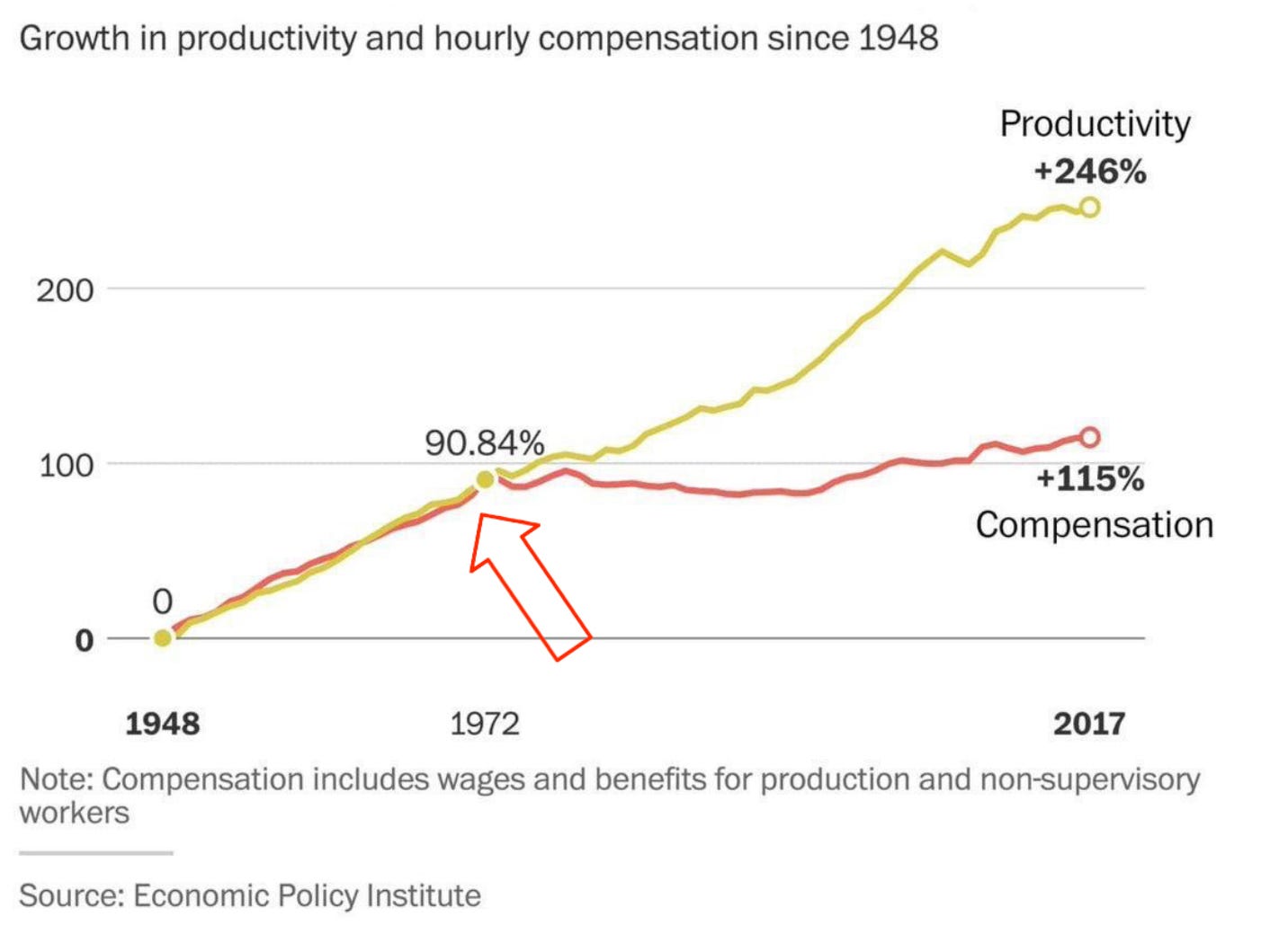

The US accelerated GDP growth, fueled by the US dollar dominated fiat currency system established in 1971, has been characterized by uneven distribution, contributing significantly to the current economic disparities observed both within the United States and globally. In the last 500 years the rich and powerful at the end of a reserve currency cycle have all done the same: Tried to prevent major redistribution of their wealth to the have-nots. It is a natural instinct and main personal objective that is this time around not different.

With the context above the underlying objectives of Trump’s Liberation Day Speech are the following to me:

Creating dilemma for the FED to win influence over her like Jackson, FDR or at least Truman.

Prevent trade agreements of e.g. EU with Canada and Mexico or China with Panama or Mexico. The US’ zero-sum approach contrasts with the potential for other countries to create non-zero-sum outcomes through cooperative trade arrangements, effectively isolating the US This isolation represents a significant strategic vulnerability.

Force trading partners into trade agreements that guarantee investments on US soil.

Create a cryptocurrency reserve and buy tokens and coins via the FED or another government institution. Using the inflating dollar as long as people mutually agree that it holds value to exchange it into cryptocurrencies like Bitcoin, is a no brainer trade.

Establish sovereign Chapter Cities, granting them the right to use own cryptocurrencies as legal tender.

Grant Chapter Cities the right to set own regulations comparable to the Próspera case study.

Finance and push the AI Manhattan Project - the geopolitical landscape of the 20th century was dominated by nuclear devices, the 21st will be dominated by AI weapons, robotic and drone swarm capabilities.

Ugh. Terribly awfully bad. Not looking forward to this next chapter. Thank you for doing the work and laying it out so clearly.

This gives Trump and his cronies way way too much credit. I seriously doubt Trump has ever read a professional article on anything economic or historical and am absolutely sure he's never read a book about anything except maybe Hitlers manifesto. So that leaves his cronies. What are they telling him and is his policy based on whomever has his attention at the time. So even if there are historical economic parallels I'm sure they are, to anyone in Trumps orbit, beside the point. Your information was exceptional and I learned a lot. Thanks.