Capital Flight and the Echo Chamber: Trump, Truth, and the Bond Market

Denial and groupthink are obscuring the economic reality.

This week's spike in US bond yields demonstrated the bond vigilantes' powerful return. Clinton advisor James Carville famously described this force, which can dictate terms to world leaders, after the 1994 Bond Massacre:

I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.

Facing a shifting global landscape marked by China's ascendance, President Trump, at the helm of a declining US superpower, initiated a global trade war, effectively dismantling the established post-war order. He shared the prevailing view that the US market's leverage, representing 13% of global imports, would continue to decline over the coming years. Therefore, he decided, that the time to force negotiations over terms for an updated global packing order is now. However, the market's response to his opening move, particularly the US bond market's reaction, pushed him to reassess his strategy of confronting the whole world simultaneously. Two theories attempt to explain the resulting bond sell-off that shook the US markets evolved over the last few days:

Margin calls triggered a need for cash among hedge funds, leading many to liquidate their US bond holdings, a common form of cash equivalent for them. (These funds frequently employ leverage, using borrowed money to amplify their trading positions beyond their own capital. When a trade moves unfavorably, they hit critical thresholds requiring them to deposit more cash or collateral to avoid a forced liquidation of their position.)

Allied nations have prepared an answer for Trump’s opening move: Canadian PM Carney floated the idea of selling US bonds during a meeting with EU representatives end of March. Given Canada's increased holdings, now over $0.35 trillion from roughly $0.1 trillion in 2021, and the EU's substantial $1.5 trillion position, those two hold significant leverage over the US. There are also claims that Japan, holding another $1.0 trillion, joined this coordinated sell-off, contributing to the surge in treasury yields. Together, these three hold approximately 30% of US bonds owned by foreign nations.

There is no hard proof for either of those options. Especially the latter appears constructed though: While Carney, with his history at the Bank of England and Bank of Canada, is absolutely knowledgeable regarding monetary policy, it is simply a fact that the Bank of Canada and the ECB, Europe's central bank, are independent institutions. In the same way Trump is not able to assert direct control over the FED's course of action, Canadian and European leaders can't either. Japan even publicly announced that they would not use their bond holdings as leverage.

Trump is acutely aware that the greatest threat in his initiated trade war is other countries forming new trade agreements that exclude the US, as I previously discussed in S1E3, Trump's Bank War. Subsequently, he threatened publicly after the Canada-EU meeting, which took place at the end of March:

If the European Union works with Canada in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both in order to protect the best friend that each of those two countries has ever had!

Orchestrated or not, it is a matter of fact that Trump, understanding how severe and painful retribution to an escalating trade war would be, abruptly reversed course, announcing a 90-day pause on all tariffs except those imposed on China.

One might assume Trump's reversal would have calmed the markets, but the reality is the opposite. As Bloomberg reports, Wall Street and global investors remain deeply unsettled by his actions.

The chart above illustrates the exchange rate between the US dollar and the Euro. At the start of Trump's presidency, one dollar was worth approximately 0.97 euros, but currently (at the time of writing), it has fallen to around 0.88 euros. This represents a significant decline in the dollar's value.

It's crucial to note that this currency weakening is unusual in the context of a trade war. Typically, imposing tariffs tends to strengthen a country's currency, as was the case when Trump previously levied tariffs against China during his first term.

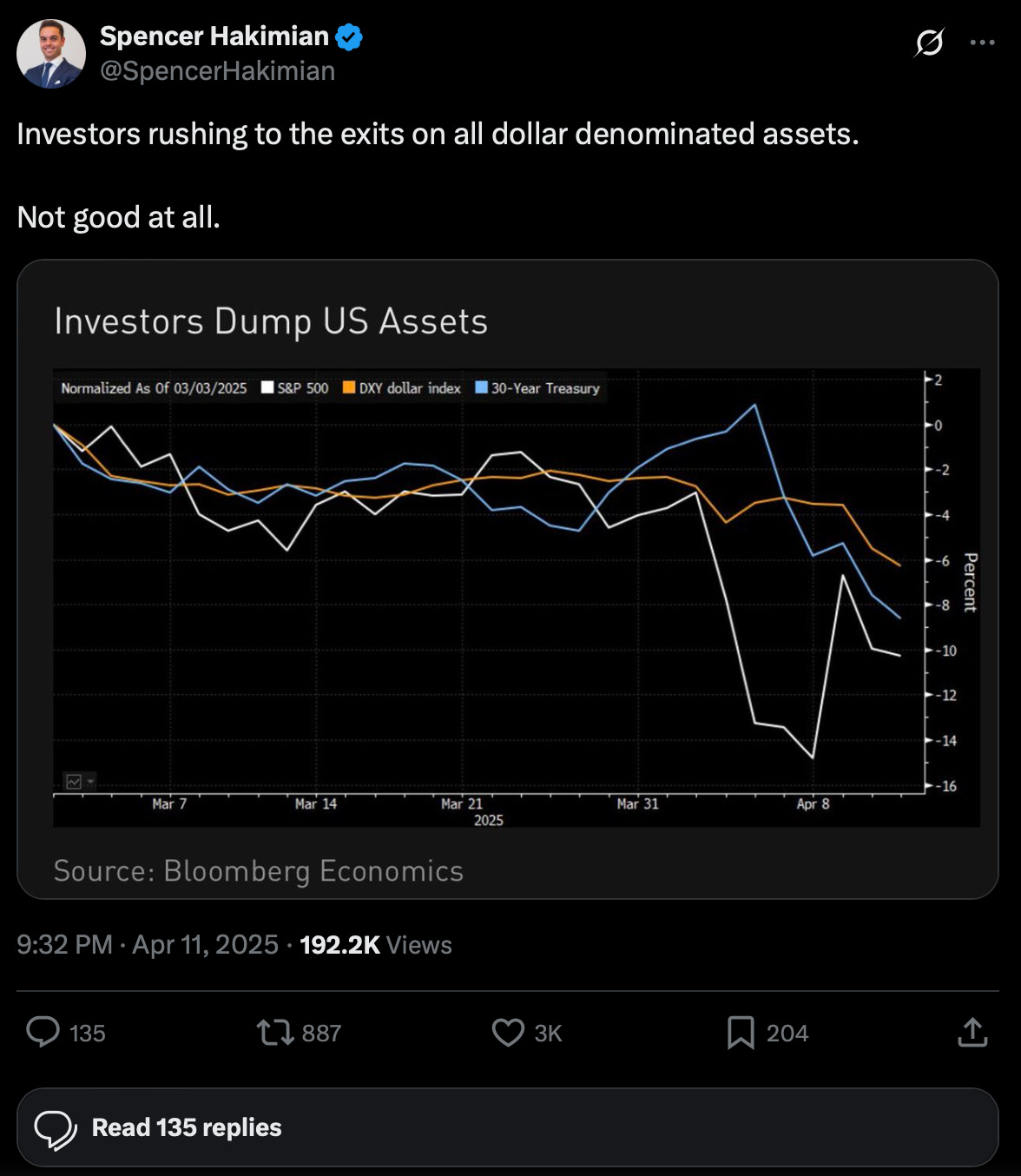

However, the current situation is different. Instead, investors are engaged in large-scale selling of US bonds and other US assets in general:

It is really crucial to understand that this combination of rising US bond yields and a falling dollar is a highly irregular and alarming scenario. Investor’s are not only getting out of US assets, they sell those and exchange the dollars they receive into assets abroad. We see for instance German bonds, the Euro, Yen or Gold spiking. Trump told the world, that the American-led order is over and appears as if the capital markets believe him and anticipate even more disruptive moves by him.

My interpretation, oriented by what the Heritage Foundation suggests in their Project 2025 paper regarding the FED, and the direction in which his close advisors Musk and Thiel appear to be influencing Trump's thinking, remains the same: He wants executive power over the FED, and it appears to be in his interest to inflate the dollar to devalue the outstanding bonds. After 54 years of the US shopping with an unlimited credit card, the bill is due, and Trump doesn't feel like paying. In a legal challenge before the Supreme Court, this week, Trump was seeking the authority to remove two Biden appointees from U.S. labor boards, arguing against existing federal laws that require cause for their removal. Bloomberg interpreted it as part of a legal strategy with which the administration attempts to overturn the Banking Act of 1935. Exactly that kind of move that would essentially bringing the FED back under full control of the executive branch.

The result we see is nothing short of capital flight - something we have not seen happening to the US in decades. The fact that he introduced numerous additional exceptions, even to the Chinese tariffs, on Friday only serves to highlight the irrational nature of his decisions. This erosion of trust has led to an irreversible decline in crucial soft power, resulting in consumers increasingly shunning US products and a significant drop in travel to the US, as illustrated in the following Financial Times graphs:

The Art of the Deal Echo Chamber

Given all those facts, it was especially astounding how quickly and in what way the narrative surrounding his actions changed: From arguing how right Trump is about the unfair treatment of the US and that it is time to bring back jobs by imposing tariffs to claiming that we have witnessed an Art of the Deal Masterclass, while all of this was about isolating China all along. Not only people who simply do not know better, but also economically well-versed individuals on Substack and beyond showed that pattern.

The current state of public discourse increasingly mirrors the patterns seen in societies dominated by authoritarian or totalitarian regimes, particularly the intense focus on Trump as central figure. There's a growing sense that the polarization within US society has reached a critical juncture, where the power of reinforcing group dynamics threatens to eclipse objective truth, making it possible to persuade large segments of the population to accept falsehoods as facts, enabling that administration to sell black for white and vice versa.

Following the Second World War, a key focus of the scientific community became understanding the ease with which groups can become self-reinforcing bubbles of thought and action. Researchers sought to dissect the mechanisms behind the personality cults that propelled leaders like Mussolini, Stalin or Hitler to power. They grappled with the unsettling paradox of how individuals, described by those who knew them as upstanding members of their communities, could participate in the barbarity carried out by SS death squads during the Final Solution or during Operation Barbarossa on the Eastern Front.

In 1950, Solomon Asch, a pioneer of social psychology, designed his now-famous conformity experiment, aiming to understand the extent to which individuals yield to peer pressure. In Asch's setup, participants were placed in a seemingly straightforward task: judging the length of lines. They were shown a ‘standard’ line and asked to identify which of three comparison lines matched its length. The catch? The participant was surrounded by several other individuals (actors, working with the experimenter) who, on certain ‘critical trials’, unanimously gave the wrong answer. The real participant, often the last to respond, was then faced with a stark choice: trust their own eyes or conform to the clearly incorrect majority. Over the 12 critical trials carried out, approximately 75% of participants conformed with the wrong answer at least once.

When participants were allowed to give their answers privately, conformity rates plummeted to 1%. This pointed towards normative social influence - the desire to be liked and accepted by the group - as a key driver of conformity. Participants often went along with the wrong answer not because they genuinely believed it, but because they didn't want to stand out or face potential social disapproval.

We humans are inherently social creatures. We crave connection, seek validation, and due to that many of us find comfort in the familiar embrace of a group. It is this very desire for belonging which can sometimes lead us down a path where shared beliefs are amplified, dissenting voices are silenced, and the collective mind becomes an echo chamber, resonating only with its own reflections.

Understanding our fundamental human nature is, I believe, key to grasping the roots of this developing personality cult. The inherent tendency towards group reinforcement, however, necessitates a clear us vs. them dynamic with those who don't conform though. Asch’s experiments also showed, that the mere presence of a single dissenting voice within a group drastically lowered the rate of conformity - simply by sharing the own perspective not by trying to convince any group member that they are wrong.

II always thought that the film 12 angry men was a good example of the conformity experiment

Making the same mistake in 2 out of 3 opportunities is usually fatal to further confidence. So just re-electing Trump was enough to trigger a steep decline in international trust in US governance. It is now in total free fall and a long way from bottom. US treasuries are just one point of vulnerability in a world that has been losing confidence in US political leadership for decades and has now decided that a major shift in political,military and economic alignments is inevitable.